Employers must retain Form I-9 for a designated period and make it available for inspection by authorized government officers. The list of acceptable documents can be found on the last page of the form. The employer must examine these documents to determine whether they reasonably appear to be genuine and relate to the employee, then record the document information on the employee’s Form I-9.

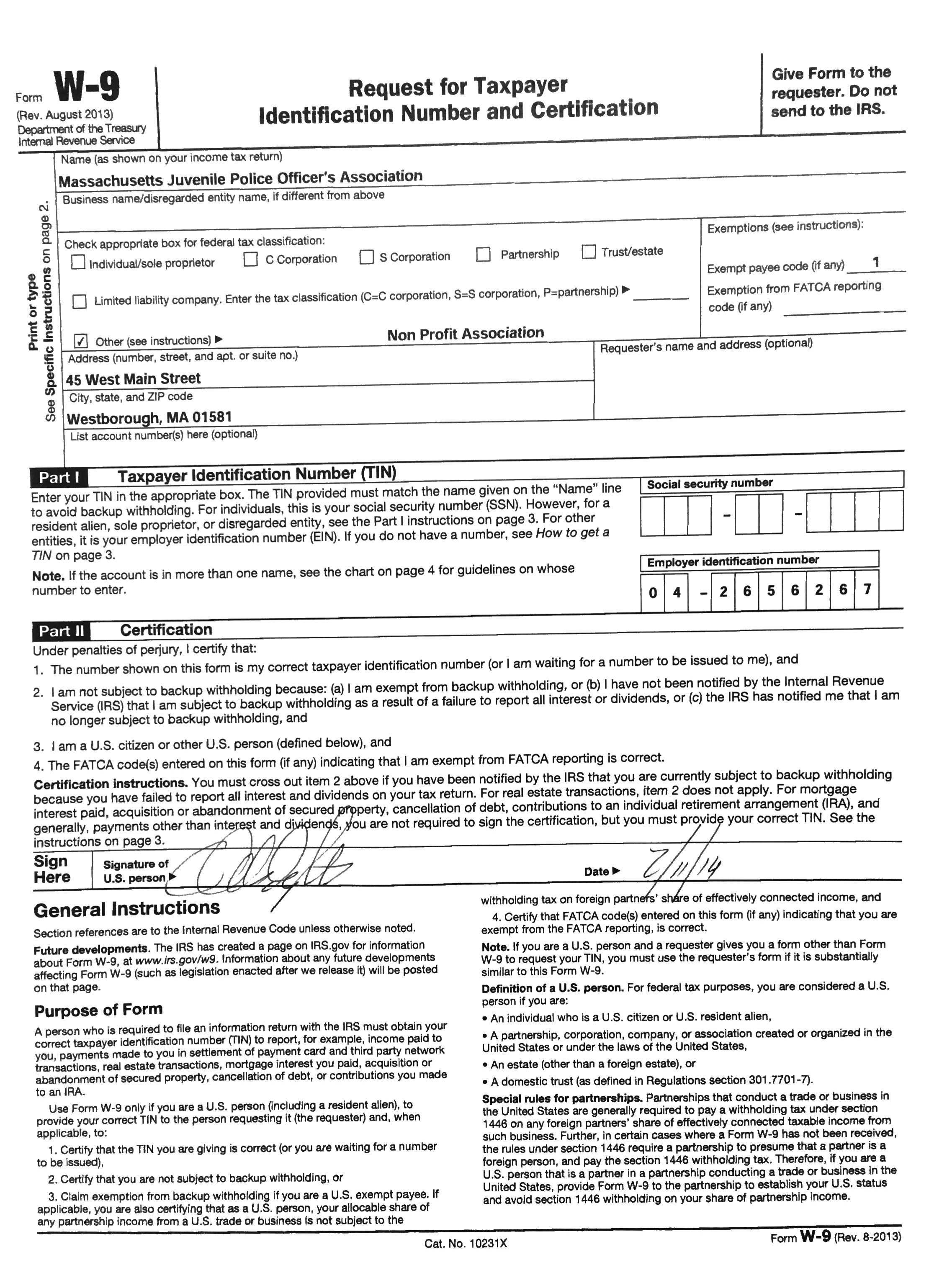

The employee must also present their employer with acceptable documents as evidence of identity and employment authorization. On the form, an employee must attest to their employment authorization. The taxpayer must file (1) an application for an Individual Taxpayer Identification Number (ITIN) and (2) any tax return for a prior year (e.g., if the tax is equal to, exceeds, or is in excess of a current tax liability for a prior year an extension of time for filing the return is available for those requesting one, but the tax must be paid b. Both employees and employers (or authorized representatives of the employer) must complete the form. employers must properly complete Form I-9 for each individual they hire for employment in the United States. Learn how to maximize health care tax credit & get highest return. Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. You must file tax return for 2022 if enrolled in Health Insurance Marketplace plan. An individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (.

0 kommentar(er)

0 kommentar(er)